While April revenues were stronger, mainly because of Easter, Southwest Airlines CEO Gary Kelly said this morning that May revenues are running “quite soft.”

Monthly Archives: May 2009

Southwest Airlines Announces New Service to Milwaukee

I’m at the Southwest Airlines annual meeting. The airline just announced new service to Milwaukee, Wisconsin.

Let the air wars begin.

Judge Strikes Down Mesa Air Group/Yucaipa Deal To Use “Aloha Airlines” Name

Thursday Federal U.S. Bankruptcy Judge Lloyd King disqualified Mesa Air Group as a co-bidder for the right to use the “Aloha Airlines” corporate identity.

You may recall that Ron Burkle’s Yucaipa Co., Aloha’s largest creditor, had put together a cozy little deal with Mesa Air Group last last year that would have seen Burkle drop the antitrust lawsuit that Aloha had filed against Mesa Air Group in which Aloha alleged that Mesa had attempted to drive Aloha out of business by starting up its lowfare carrier “go!” in Hawaii. In return, Mesa had agreed to enter into a “licensing” agreement in which it would pay Yucaipa for the right to use the “Aloha” name and brand.

There was just one little hitch to this deal.

It had to be approved by the bankruptcy judge handling the Aloha bankruptcy.

And here is where the plan came unglued.

In December, after Yucaipa bid the highest amount for the use of the “Aloha” name as part of the airline’s bankruptcy proceedings, (over Hawaiian Airline’s competing bid), Judge King blocked the deal as he questioned the motives behind the move by both airlines.

“How about all the people whose lives were devastated in this case?” asked King, noting that Mesa and go! were largely blamed for Aloha’s demise. “Doesn’t that count? Is it just the money?”

At that time, King postponed a hearing that would have given the okay to the proposed licensing pact, and instead set a new date of Feb. 19 — so that opponents and supporters of the deal would have more time to respond.

In March, Judge King threw out the sale of the Aloha Airlines name and other intellectual property to Mesa.

Judge King, emphasizing that the auction to buy Aloha’s intellectual property should have been a public process, blasted the attorneys conducting the auction for refusing to allow Honolulu Advertiser reporter Rick Daysog into the proceedings. Daysog wrote a letter to the court voicing his complaint about his being excluded from the proceedings. King ruled that the auction must be reheld.

Which brings us to Thursday.

According to a report in the Star-Bulletin dated May 15, King said he was denying a renewed motion by Aloha’s Chapter 7 trustee, Dane Field, to conduct an auction for Aloha’s intellectual property rights because Yucaipa had a deal to license the Aloha name to go! for 10 years.

“Standing alone, with no connections to Mesa and appropriate assurance that no interest in the Aloha IP would ever pass to Mesa, there is no apparent cause to deny Yucaipa the ability to credit bid,” King wrote.

However, he said that since the trustee’s motion and the asset purchase agreement do not identify Mesa as a co-purchaser or even mention the license of the intellectual property which Yucaipa is obligated to give to Mesa, “cause exists to deny the credit bid.”

“This court has an independent power and duty to examine the propriety of a proposed sale of property of a bankruptcy estate, and it cannot allow its authority to be misused in a way that would reward Mesa for its misconduct,” King said.

USAPA Loses; Former America West Pilots Prevail in Seniority Fight

Hello everyone. As I type this I am sipping a bourbon and seven with a twist of lime at the Mississippi Airports Association Conference in Natchez. Yours truly is the kick-off speaker for this event tomorrow morning… So pardon any typos as this is an iPhone post.

But I just received word the jury in the federal trial in Phoenix involving former America West pilots and US Airways East pilots has found USAPA “responsible” for adequately representing the rights of the 1800 former America West pilots.

To cut through the legalese… This was a civil trial.. Not a criminal one. As such, this is the same as “guilty.” it was a unanimous decision by the nine-member jury.

As readers know — this is all about seniority. Or rather, how the US Airways East pilots refused to accept the blended seniority award that was handed down as part of the ALPA guidelines.

As I said recently in PBB, I assumed this was going to be the outcome of the trial…. But now what?

This is not going to make both sides kiss and make up … And forget what has happened.

But hey… At least for tonight … The former AWA pilots can celebrate. Have one on me guys!

Virgin America: Now It’s Not Just Us Questioning the Airline’s Financial Viability

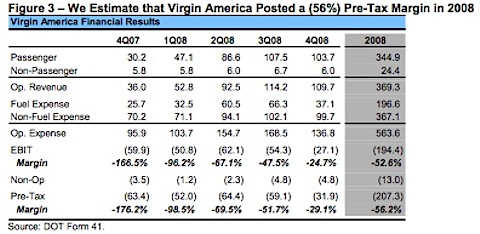

Monday the Bureau of Transportation Statistics of the DOT issued the latest Form 41 data for the industry. The information covered the fourth quarter 2008 numbers.

Needless to say, for airline geek types, the release of Form 41 data is like a huge box of goodies, all wrapped up with a nice big bow. The only problem is — you have to take the time to get in the box and carefully unwrap all the nuggets.

This morning analyst Gary Chase with Barclays issued a research note on Virgin America’s financial situation — a note that was clearly based on Gary and fellow analyst Dave Fintzen’s careful unwrapping of the Virgin America nuggets.

But wait — Gary doesn’t even cover Virgin America. The airline is not publicly traded.

Oh, but he does cover airlines that are currently affected by the airline’s presence. Most notably JetBlue and Alaska Air Group. Of all the major airlines Virgin overlaps about 25% of JetBlue’s capacity, while it overlaps about 17% of Alaska’s.

In his note this morning, Gary noted that while Virgin has been in the news a good deal lately because of questions concerning its ownership structure — “we cannot know the details of the company’s ownership structure.” But Gary and company can, and did, analyze the airline’s operating performance for the fourth quarter as reported to the DOT.

The verdict?

“The airline is now beyond the point in its development where JBLU turned profitable; Virgin America’s results would show losses in late 2008 even at sub-$1.00 fuel prices.

DOT filings point to substantial losses that go well beyond high fuel prices. We estimate that to break even in 2009 (similar to the rest of the industry on an un-hedged basis), the airline would need to drive significant improvement in revenue or cost performance, or both. For example, one path to break-even would be to achieve a roughly 20% higher unit passenger revenue (in an environment where industry RASM is declining by nearly 10%) and reduce non-fuel costs by almost 10% while fuel prices remain at the $1.49 level.”

He continued, “Virgin America’s premium strategy, including its First Class and Main Cabin Select products, does not appear to be generating a meaningful revenue premium. Rather, unit revenue performance lags JBLU and the industry at-large. Virgin America’s unit revenue performance has shown relative improvement as the airline spools-up, but still lags a typical new JBLU markets despite having a first class option and fewer seats on an equivalent aircraft (which should translate into both higher RASM and CASM). While Virgin America has found some relative success in short-haul West Coast markets, revenue performance in Transcon and longer-haul West Coast (i.e. Seattle) lags the industry by a wide margin.”

In addition, Gary said, “The premium strategy likely contributes to the airline’s relative cost problem, with non-fuel unit costs that are 40% higher than JBLU today and ~30% higher than JBLU at the same point in its life cycle. Unit cost tends to improve dramatically during the first year of an airline’s operations, but Virgin America is now beyond the point where JBLU’s cost structure stabilized. The cost structure remains significantly higher than JBLU, not to mention other low-fare airlines.”

In typical carefully worded “analyst-speak” he concludes: “We believe the Virgin situation represents a potential opportunity for the industry generally, but for JBLU and ALK in particular. Even if the press surrounding the ownership structure proves inaccurate, operating losses could also prompt a move away from its Transcon and long-haul West Coast routes, where performance has been the weakest.”

So how bad were the numbers themselves?

Virgin America’s recent DOT filings show the airline posted significant losses through its first year of operations. In total, the airline posted a 2008 pre-tax loss of ~$207mm on revenue of ~$370mm, for a pre-tax margin of negative 56%. While margins did improve, DOT reports show 4Q08 pre-tax margin was a negative 29% with a pre-tax loss of $32 million.

Now, is there anyone out there who still wonders why it was that Virgin America fought for so long to keep from reporting its results to the DOT?

I didn’t think so.

Airlines: Don’t Look Now, But Oil Prices Are on the March

In the midst of all the giddy sentiment that is starting to take hold in the industry concerning the “stabilization” in demand decline — a fact that April RASM estimates issued by some airlines have fueled this week — a new ugly problem is starting to make itself known. That ugly problem? Higher fuel prices.

As they say, if it’s not one thing, it’s another in this industry.

The big question concerning the recent relatively calm period of lower oil prices was this one — how fast would they start to ratchet up when the economy began to shows signs of recovery?

We, unfortunately, are starting to see that apparently the answer to that question is — pretty fast.

If you have not looked at the oil futures market lately, here is the bad news. As I post this (at about 1:30 PM CDT), the price of a barrel of crude is now sitting at 58.55, up almost $2 bucks for the day. Just two weeks ago, the price of crude closed at 50.80. Last Friday, it closed at 53.20.

Today’s price is the highest price that crude has posted since November.

What is fueling the push?

A combination of some encouraging signs on the economic front, U.S. equity markets that seem to believe the worst is over (whether it is or not) and a weaker U.S. dollar.

As most of you know, a declining US dollar makes dollar-priced oil cheaper for foreign buyers and tends to encourage demand, leading to higher prices.

Yes, it is indeed a vicious circle.

And one damn frustrating one if you are an airline. Do you hedge or not? At what price levels? With what hedging instruments?

Remember that many airlines were still paying the price (and dearly) in the first quarter for making the wrong move on oil futures last year.

What makes this rapid rise in the price of oil potentially more troubling for the industry than the record-breaking rise last summer is that it is rearing its ugly head at a time when the level of demand, i.e., revenue, has fallen through the floor.

Airlines’ April RASM Numbers Continue to Look Good

It’s that time of the month once again. That time when the airlines report their traffic (and in some cases estimated revenue per available seat mile (RASM) performance) for the previous month.

Remember, while higher load factors are nice, what’s even better is knowing those butts in seats paid more, not less, for the privilege.

The reporting kicked off with Continental Airlines, as always, which issued their numbers late last Friday. The result there?

The airline estimated that its April consolidated RASM was down 12.5-13.5%. While these numbers might look ominous, the results are actually on the high side of the range last given by the airline.

The airline had originally said that it expected RASM to be down between 13-15%.

While only a small improvement over what had been expected — the key word here is “improvement.” Not unexpected “decline.”

US Airways also gives monthly RASM guidance, as does JetBlue. So Tuesday it was time to parse through the US Airways numbers.

US Airways said Tuesday that its total April mainline traffic fell 3% from a year ago to 5 billion revenue passenger miles. Capacity fell 4.8% to 5.9 billion available seat miles, while its load factor rose 1.6 points to 84.8%.

More importantly, the airline said that consolidated passenger revenue per available seat mile (PRASM) was down approximately 8% to 10% versus the same period last year while total revenue per available seat mile decreased between 4% and 6%on a year-over-year basis.

Again, these numbers were just a tad better than previously forecast, as the airline had said it expected April RASM to come in down around 10%.

Yes, it does look like the declines in revenue have begun to level out.

Okay, so who’s going to pick up the tab for the cold beers this afternoon? Yee haw.

Airline Industry Not Happy With Biden; WHO Debunks Usefulness of Travel Restrictions

Thursday morning Vice-President Joe Biden said on NBC’s Today Show, “I wouldn’t go anywhere in confined places now. It’s not that it’s going to Mexico, it’s [that] you’re in a confined aircraft; when one person sneezes it goes all the way through the aircraft. . .If you’re out in the middle of a field and someone sneezes that’s one thing. If you’re in a closed aircraft. . .it’s a different thing.”

Thank you Joe.

Unfortunately, we all know he’s right. Then again, the same could be said for riding in an elevator.

However, knowing that being in a small confined space with recirculated air for hours is probably not the best place in the world to be if someone in that space has something contagious is not what the airline industry needs to have said by a top government official on television. Not right now.

The Air Transport Association immediately blasted the comments, with CEO Jim May expressing “extreme disappointment at your suggestion that people should avoid air travel.”

The rest of the day, and even this morning, the fallout continued, with other government officials stepping up in an attempt to mitigate the damage, as did Transportation Secretary Ray LaHood late yesterday. LaHood said in a speech that “flying is safe and flying is healthy, and flying to Mexico is safe.”

Meanwhile, this morning the World Health Organization said that it was not recommending travel restrictions related to the outbreak of the virus. “Limiting travel and imposing travel restrictions would have very little effect on stopping the virus from spreading, but would be highly disruptive to the global community,” WHO said in a statement.

One of the reasons behind this statement? The lessons learned from the hysteria surrounding the SARS encounter. As WHO said in its statement, “Furthermore, although identifying the signs and symptoms of influenza in travellers can be an effective monitoring technique, it is not effective in reducing the spread of influenza as the virus can be transmitted from person to person before the onset of symptoms. Scientific research based on mathematical modelling indicates that restricting travel will be of limited or no benefit in stopping the spread of disease. Historical records of previous influenza pandemics, as well as experience with SARS, have validated this point.”

Continental Airlines Pulls the Cord on Mexico Capacity

This morning Continental Airlines announced that it was cutting capacity on its flights to Mexico by 50%.

As we noted here last week, 5.3% of Continental’s total passenger revenue is derived from Mexico flights. The airline has more flights scheduled to Mexico than any other airline, with an average of 450 flights per week.

The new schedule begins Monday.

The airline said that service to all of its 29 Mexican destinations will continue. However, the frequency of flights has been cut, and on some routes regional aircraft will replace larger aircraft.