Several weeks ago, after the GAO issued its report on the American Airlines-US Airways merger, PlaneBusiness Banter contributing editor Brett Snyder (who provides detailed analysis for PBB on various airline industry issues on a regular basis) took a very close look at the study. I had problems with the study from the get-go. As a result, I wanted someone to pick it apart for us and give us their opinion.

The conclusions Brett came to were more or less the same ones we took from the study at the time: besides there being problems on several key data issues, there was nothing in the study that would serve as evidence that a merger between the two airlines was anti-competitive to an extent that would warrant a thumbs-down by the DOJ.

We have had numerous requests, since the DOJ’s announcement last week, to repost this analysis publicly — outside the PBB subscriber firewall. So — here you are. This column originally ran in PlaneBusiness Banter on Friday, July 19.

______________________________________________________________________________

July 19, 2013 — PlaneBusiness CrankyAnalysis: The GAO Report On American/US Airways Merger –More Holes Than Swiss Cheese

Editor’s Note: This week PlaneBusiness Banter contributing editor, analyst, and chief airline dork Brett Snyder takes a look at the recent GAO report on the pending merger between American Airlines and US Airways. Given a flurry of “anti-competitive” articles in the press of late, and given some obvious data issues with the GAO report, we thought it was important to take a deep dive into the data. Brett, as usual, was more than ready for the challenge.

______________________________________

C R A N K Y A N A L Y S I S

By Brett Snyder, Contributing Editor, PBB

As American and US Airways march ever closer to finalizing their merger, there is still one big hurdle to overcome… government antitrust approval. This shouldn’t be difficult, but lately there has been some bad press trying to seed doubt on whether the merger will be approved.

Much of this backlash is being fueled by a government report that is woefully incomplete at best. I thought it would be a good idea to take this thing apart so that the real impact can be shown.

The report in question is from the Government Accountability Office (GAO). The GAO issued its report on June 19 entitled, “Issues Raised by the Proposed Merger of American Airlines and US Airways.” In the 31 page document, the GAO brings up a lot of potential issues and opponents of the merger have flocked to this as some sort of smoking gun. It’s not.

First, let’s get one thing out of the way. Will this merger reduce competition? Of course it will. If you have a set of competitors and two of them merge, then there will be fewer competitors in the market. That means less competition, but it’s hardly a reason to deny the merger. The key is for the government to determine whether the merger will harm competition enough that it creates an antitrust concern. That’s where things get difficult.

The GAO did some math to calculate what the effect of the merger would be on the routes currently flown by the two carriers. It took a year’s worth of traffic in each domestic airport-pair and then defined an effective competitor as one that had at least 5 percent of the traffic. After eliminating markets with fewer than 520 passengers each way during that year, it then looked at markets that would see the loss of an effective competitor.

I immediately saw some problems with some of the agency’s conclusions. So we set out to take a look at the underlying data and do our own research.

Unfortunately, the GAO told us that it had “outsourced” the data search to a consulting firm, therefore it could not share the underlying data.

I’ve been working with masFlight to try to recreate the analysis. So far, we’ve been unsuccessful at getting it to match up exactly. But we did get pretty close. The total number of markets that would lose an effective competitor was 1,665 according to GAO. The media, much less merger critics, rarely mention that 210 markets will actually gain an effective competitor, but we don’t need to focus on that. It’s really this revelation by the GAO that is what everyone needs to focus on.

“However, the great majority of these markets also have other effective competitors.”

Let’s take a closer look at those 1,665 markets.

Of those markets, more than 70 percent will still have 3 or more effective competitors. It’s hard to argue that those are going to be markets without significant competition even after the merger. In fact, competition will be heightened in some markets since the new American will have enough heft to provide serious competition to United and Delta. So let’s focus on those markets that will either become monopolies or will be reduced to having only one other carrier in the market after the merger since those are the ones that would be most concerning.

According to the GAO, there are 24 markets that will drop from 2 effective carriers to only 1 after this merger (we found 23) and 475 markets that will will go from 3 to 2 effective carriers (we found 484). But during the process of putting our own analysis together, we found a few problems with the analysis by the GAO.

1) The GAO included both interline and domestic codeshare itineraries in its analysis. That is misguided. Of the 484 markets dropping from 3 to 2 carriers, a full quarter of them aren’t even served by both carriers today. Wait, what?

For example, let’s take a look at a market like Charlotte to Midland/Odessa. US Airways doesn’t even fly to Midland and doesn’t even file fares in the market, but you have people who fly US Airways to Dallas or Houston and then connect on American or United from there. Does US Airways really deserve to get credit for this passenger? And will competition really be reduced after the merger? I find that hard to believe. You’ll have two strong carriers in the market

Or look at Reno to Wichita. US Airways does sell tickets in this market because of its current codeshare with United. Together, United and US Airways have 75 percent of the market and they are hardly competing with each other. When American and US Airways merge, that will reduce the percent of travelers flying on United to under 60 percent. American and US Airways together will be a much stronger competitor than American alone.

If we eliminate those markets, that leaves us with only 371 markets that will see truly reduced competition.

2) Of those 371 markets, nearly 30 percent have significant service from other carriers at alternate airports. However, the GAO report utilizes numbers only for specific airport-pairs even though in antitrust analyses, you’re supposed to look at total city-pairs. So why isn’t that happening? According to the report itself:

“It is generally preferable, time permitting, to assess city-pair, rather than airport-pair, changes in competition. Some larger U.S. cities (New York, Chicago, Los Angeles, Washington, D.C.) have more than one commercial airport that can compete for passenger traffic. DOJ generally considers the relevant market to be a city-pair combination, but also examines the airport pair if relevant.”

In other words, GAO didn’t have the time to do the full and proper analysis, so it just put out what it could. It’s very strange that GAO would do this, particularly since the inclusion of Washington’s National and Dulles airports as members of a single city pair in an antitrust analysis more than a decade ago was a huge contributor to the failure of the United/US Airways merger.

If we take out markets with significant service from other airlines in alternate markets we’re down to 265 markets, give or take.

3) Looking at those 265 markets that will go from 3 to 2 competitors, will these markets really see a great deal of harm from lack of competition? Not all of them, that’s for sure.

Look at the biggest market left, Boston to San Juan. JetBlue is the behemoth in this market with just over 75 percent of the traffic. US Airways has about 8 percent while American has a little less than that. Combined, they will have a whopping 14 percent, but does anyone really think either of those airlines are driving pricing in this market? No way, it’s JetBlue. And that won’t change a bit.

Then there are the markets like Chicago to Honolulu. United has over 60 percent of the market. American has 25 percent and US Airways has 7 percent. If anything, this merger will make American a more effective competitor of United by allowing it to offer more options.

This is repeated over and over again in many markets. So will any markets truly suffer? Sure. These are mostly smaller markets. Cities that come up over and over in the data are places like Tallahassee and Chattanooga. These are cities that will see reduced competition, but is it enough to deny a merger that will provide so much benefit in other ways? I don’t see how.

The markets that should cause the greatest concern are naturally the ones where competition will be eliminated entirely. So let’s take a look at those markets. GAO shows 24 markets that will have service by only one airline after the merger. Our analysis turned up 23, including 2 of which weren’t on the GAO list (GAO had 3 that weren’t on ours). So let’s look at all 26 of them.

- 3 markets are interline markets that aren’t served by both airlines. Burbank-Dallas/Ft Worth was served by American but the airline has since pulled out of Burbank entirely. Meanwhile, Dallas/Ft Worth-Lawton and Dallas/Ft Worth-Williamsport simply aren’t served by US Airways and American. Throw these out.

- 7 markets are to St Croix, a market that is only seasonally served by US Airways. Considering American’s strength in the Caribbean this merger might create more service for St Croix in the end since US Airways provides very little today.

- 2 markets no longer have US Airways as an effective competitor when including alternate airports (Boston-Miami and DFW-San Jose). US Airways doesn’t take enough traffic in the city-pair analysis to break that 5 percent threshhold.

- 10 markets have more effective competitors in alternate airports. This is particularly amusing since the GAO report states,

“And unlike the United/Continental merger, where most of the endpoint cities had other airports in the region, fewer of these airport pairs have significant other airports in the region. This is especially true for the Charlotte (CLT)/Dallas (DFW) and Phoenix (PHX)/DFW pairs where few alternate options are available at either endpoint.”

The piece about Phoenix to Dallas/Ft Worth is just so wrong. So very, very wrong.

Spirit does not carry a ton of traffic today between DFW and Phoenix/Mesa but it does serve the market. More importantly, Southwest carries more than 20 percent of the market between Dallas and Phoenix when you include Love Field. And starting next October, Love Field opens up and Southwest can fly anywhere it wants from there throughout the US. I can guarantee that Phoenix will be one of the first cities to get nonstop service so it should grow its share more.

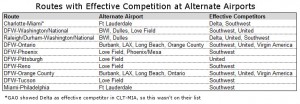

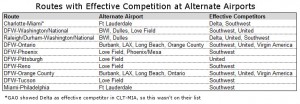

Here is how these ten markets break down.

Where does that leave us? It leaves us with a grand total of 4 markets that would be truly impacted by the merger. There’s DFW to both Philly and Charlotte, Charlotte to St Thomas, and DFW to Palm Springs.

The point here is not that competition won’t be impacted at all. It would be silly to claim that. The point is that the impact won’t be nearly as dire as has been suggested and there will be real benefits as well.

While I wouldn’t be surprised to see the Feds require that some slots be surrendered at Washington/National to gain approval, I find it hard to believe that the Feds could find a way to reject this merger on antitrust grounds.

________________________________

Brett Snyder

Brett is the author of the award-winning airline industry blog The Cranky Flier and also runs his Cranky Concierge air travel assistance business. Though Brett has loved the industry since he was a kid (and was even a travel agent at the age of 12), he only began working for the airlines as a college intern for USAir. After graduation, he did pricing for America West and marketing for United, among other roles.

In 2005, Brett created the travel search site for leading comparison-shopping company PriceGrabber.com. He graduated from The George Washington University with a bachelor’s degree in business in 1999 and received a Master of Business Administration from Stanford University in 2004. He lives in Long Beach with his wife, son, new daughter, and two dogs. You can find him on Twitter under the name @crankyflier and you can email him at cf@crankyflier.com.

Good evening earthlings. Our last summer “kitchen sink” issue of PlaneBusiness Banter is now posted. Alas. We were supposed to already be on vacation. But then the Department of Justice decided to sue American Airlines and US Airways last week.

Good evening earthlings. Our last summer “kitchen sink” issue of PlaneBusiness Banter is now posted. Alas. We were supposed to already be on vacation. But then the Department of Justice decided to sue American Airlines and US Airways last week.