Today the Wall Street Journal ran a story which seems to confirm what we had assumed was going to happen, as we had discussed in PlaneBusiness Banter a number of times over the last several months.

The two “U.S.” firms that invested in Richard Branson’s Virgin America operation have apparently taken advantage of the fine print in their investing agreement with the airline and headed for the hills.

These investors controlled 77% of the airline.

Since U.S. carriers must be at least 75% owned and controlled by U.S. investors, this departure would seem to place Virgin America’s status as a US-owned carrier in jeopardy. Unless the airline has somehow been able to find other U.S. based investors to fill the void. But as far as we have heard, that has not happened.

Word on the street for the last several months has been that Black Canyon Capital and Cyrus Capital Partners were going to pull the trigger on their investment. Heck, in my opinion they would have been crazy not to. The two negotiated a sweet “out clause” when they put money into the venture.

By pulling the plug now, the two were entitled to receive all of their original investment back, plus 8% interest, amounting to roughly $150 million combined between the two.

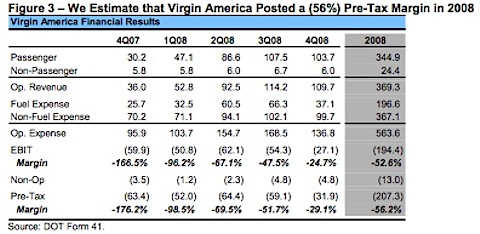

Not bad, considering the airline the two “invested in” has done nothing but lose hundreds of millions of dollars since its start-up — a fact the airline couldn’t hide any longer after it was finally forced to submit its Form 41 DOT data to the DOT recently.

A normal person could conclude that if, in fact, Black Canyon and Cyrus have exited the mood-lighted building, Virgin America would now either a) have new investors already lined up or b) be in violation of DOT ownership requirements.

It is important to note that Virgin has not issued a statement or release trumpeting the corralling of any additional U.S. investors.

One would think that the airline would have been out in front of this — announcing new money — as a way to deflect talk of its being in violation of DOT ownership regulations or of being in danger of a possible shutdown.

But they have been noticeably mute.

Which is exactly why we are talking today about how it would appear the airline is, just as Alaska Air Group claimed in a recent complaint to the DOT, not in compliance with the DOT foreign ownership rules, and two, yes, this means the airline is in danger of being shut down.