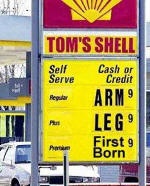

….depending on where you’re buying it. West Coast still seems to be the most expensive, with West Coast jet fuel apparently closing Friday at $4.14/gallon. Other markets are running $4.04-$4.08/gallon.

Category Archives: Oil/Energy

Oil Prices Surge Off the Charts To New Record High Price –$138.75

Ah, I’m not sure you want to look at the price of oil. Much less jet fuel.

But, I guess, alas, there is no choice.

After oil futures posted their biggest one-day surge in history yesterday — $5.49 — oil prices closed up almost $11 Friday, ending trading at $138.75/barrel after European Central Bank President Jean-Claude Trichet suggested the bank could raise interest rates. This news caused the euro to climb against the dollar.

As all good readers of PlaneBuzz know, when interest rates rise in Europe, or fall in the U.S., the dollar tends to fall against the euro. The falling dollar then also makes oil that much cheaper for buyers everywhere except the U.S.

The current record high of $135.09 was hit on May 22.

Prices were also pushed today by comments made by analyst Ole Slorer of Morgan Stanley, who wrote in a note that he expects a “short-term spike” in oil prices — the result of rising demands in Asia.

I’ll be back in a bit with an update on jet fuel prices.

Oil Goes on a Tear; Jet Fuel Follows

Just when you thought it was safe to sign that contract for the Gulfstream….

Crude oil futures took off today, closing up more than $5, to $127.79. Jet fuel followed crude’s lead, as New York Jet picked up 12 cents on the day to close at $3.77/gallon. Gulf Coast Jet was up 14 cents, closing at $3.78/gallon.

Good News on the Oil Front Today; Price Declines

Then again, there is no telling how long the lull will last.

We have had a slew of conflicting influences this week on the oil markets.

But when everything was put in the Vitamix today, and swirled around, the markets decided that perhaps oil has finally reached a point where lessening demand is starting to have an effect.

The price of crude closed down $4.41 today, ending at 126.62.

Woo hoo.

Where are those sparklers and the Twinkies?

Back in the Saddle Again…

Hi guys. I know. I’ve been absent for a couple of days. And look what happens when I go off and leave you on your own.

First, the US Airways/United deal appears to be floundering, or at least that is what the New York Times reported late yesterday. Although for those of us who read such reports carefully, if I was a betting woman, it would appear that there were some union “sources” talking to Ms. Maynard and Mr. Sorkin because of that one telltale line in the story.

The line? “In particular, it became clear that the labor agreements would have to be sorted out before the combined airline could see any of the savings from the deal, which could have been in the hundreds of millions of dollars.”

My translation of this is that union leaders wanted a seat at the table – before negotiations could go any further. And having listened to US Airways’ Chairman and CEO Doug Parker talk this spring about how he did not think giving labor a mandate to sort out their differences ahead of time was such a hot idea (aka Northwest and Delta) — I doubt that US Airways would agree to give labor that kind of position in a potential deal up front.

If the deal is indeed dead, this certainly puts Mr. Tilton and United in a strange position. After putting themselves on the block openly for years — this will be the second deal to fall through involving the airline in less than two months. So much for the great deal hunter.

I wish management at United would figure out that it’s more important to actually run a good airline, as opposed to constantly running numbers on various merger scenarios.

Alas, now it looks like the airline is rather inept at both.

Meanwhile, Airbus warned earlier this week about additional problems with its manufacturing process, and American Airlines has been announcing cuts in routes right and left — including JFK/Stansted.

American said Tuesday it is discontinuing flights between Chicago and Buenos Aires, as well as its Boston to San Diego route. It will also reduce its flights from Chicago to Honolulu to only “peak demand days.” The airline is also restructuring its operations in San Juan, Puerto Rico.

Today the airline announced it is cutting service between New York’s John F. Kennedy International Airport and London’s Stansted Airport effective July 2.

As one of our industry buddies wrote today, “I’m shocked. Simply shocked.”

Wise guy. Yeah, right.

No one should be shocked at this news, as American added this flight less than a year ago in response to competitive service on the route by EOS. EOS is now gone, so bye bye American.

Anyone taking bets as to when American finally shuts down its money-losing Love Field adventure?

But hope springs eternal at JetBlue, which this week not only announced it was delaying a slew of new aircraft deliveries — 21 aircraft for as long as five years — the airline also issued a prospectus on a $160 million bond offering.

Gotta hand it to them — it’s probably better to do an offering now than later this summer. Stock up those cash assets while you can.

Finally, while there were a lot of headlines yesterday talking about “lower” energy prices, remember that term is soooo relative. Prices yesterday were not that much lower. Not only that, but today, prices were back up again.

Crude oil closed at $131.03/barrel today, up almost 2% on the day, while N.Y jet fuel closed at $3.96/gallon. West Coast jet fuel is still running above $4/gallon.

Ticker: (Nasdaq:UAUA); (NYSE:LCC); (NYSE:AMR), (Nasdaq: JBLU)

Technorati Tags: airline CEOs, airline mergers, airlines, American Airlines, jet fuel, jetBlue, United Airlines, US Airways

Trading in Shares of SilverJet Halted

Bloomberg reports this morning that trading in shares of Silverjet have been suspended in London because the airline has yet to receive a promised $5 million investment.

The airline said today in a statement that it had asked for the money as part of a loan agreement from Viceroy Holdings LLC, a U.A.E.-based fund. But the airline said that it has yet to receive all of the money. Shares were suspended from trading on the London Stock Exchange’s Alternative Investment Market at the request of the Luton, England-based airline.

In the statement, the airline said, “Silverjet’s working-capital reserves are limited and advances under the loan facility are required as a matter of urgency,” the carrier said. “Silverjet continues discussions with other parties, which have confirmed an interest in investing in the company.”

Uh-huh.

Technorati Tags: airline stocks, airlines, Silverjet

Closing Numbers of Note: Jet Fuel Basically The Same, Oil Down a Smidge; S&P Downgrades Nine U.S. Airlines

We got a small bit of relief on the energy price front today, but not much.

Crude closed at 130.81 for the day, but jet fuel prices pretty much stayed the same, with the average closing price for New York Jet, Gulf Coast Jet, Mid-Continent, and West Coast Jet coming in at $4.09/gallon.

For the day, shares of ExpressJet posted the biggest loss for the day, as they dropped back a whopping 41%, closing at 1.61. Another day of decline for the airline — after it said Wednesday it was cutting its branded flights by 30%.

Shares of Mesa Air Group didn’t have a good day either, as the airline was forced to talk about its dwindling cash situation and potential revenue shortfall as a result of the loss of the Delta Air Lines/Freedom Air contract today in SEC filings. Shares here dropped back 16%, closing at 48 cents after the airline’s discussion of a potential bankruptcy filling. With the equity in this stock already shot for the most part, one has to wonder why the airline has not already filed for bankruptcy protection.

Republic didn’t have a good day either, as shares here were down 12%, ending the day at 12.45.

SkyWest was the one regional that pretty much held down the fort, as shares here were only down 1% on the day, closing at 15.48.

As for big Wednesday loser AMR, parent of American Airlines, the stock posted a small recovery today — but nothing to write home about. The shares recovered 5%, closing the day at 6.56, after its 24% jump off the cliff on Wednesday.

Things didn’t get much better for airline stocks after hours as S&P put the ratings of nine U.S. airlines on CreditWatch negative.

“The dramatic increase in jet fuel prices has increased airline costs significantly over the past two months, and, if sustained, could threaten their liquidity and financial profiles,” said Standard & Poor’s credit analyst Philip Baggaley in a statement.

S&P placed the following airlines on CreditWatch: AirTran Holdings Inc.; Alaska Air Group Inc., the parent of Alaska Airlines: AMR Corp., parent of American Airlines; Continental Airlines Inc.; JetBlue Airways Corp.; Southwest Airlines Co.; UAL Corp., which owns United Air Lines: and US Airways Group Inc., which owns both US Airways and America West Airlines.

Southwest Airlines, the most heavily-hedged U.S. airline, and Alaska Air Group, the second-best fuel hedged carrier, are in a “somewhat better” position than others, according to S&P.

Northwest Airlines Corp. and its Northwest Airlines unit are already on already on CreditWatch due to the proposed merger with Delta Air Lines Inc., which is currently on positive CreditWatch.

Technorati Tags: airline stocks, airlines, AirTran , Alaska Airlines, American Eagle, AMR, Continental Airlines, debt ratings, Delta Air Lines, ExpressJet, jetBlue, Northwest Airlines, regional airlines, Republic Airways, SkyWest, Southwest Airlines, United Airlines, US Airways

Herb On CNBC’s Squawkbox

Herb sits down with CNBC after yesterday’s annual meeting talking high oil prices, airline bankruptcies, employee productivity, and the lack of clear understanding on Capitol Hill about the problems affecting the U.S. airline industry.

Ticker: (NYSE:LUV)

Technorati Tags: airlines, Herb Kelleher, Southwest Airlines

“Fuel Prices Destroying Hope” …And This Was Before New Record Oil and Jet Fuel Prices

Or so said UBS analyst Kevin Crissey in a research note today.

“The legacy airlines have grown passenger revenue 7% so far this year. Although this is a good result by historical standards during a period of weak economic growth, it is not remotely close to what’s needed (think 4x this amount). Spot gulf coast jet fuel prices are up an incredible 85% y/y. The industry needs to shrink in a huge hurry to be able to raise fares and reduce fuel burn and other expenses.

It is difficult to make a compelling (or even decent) case to buy any US airline stock right now. The status quo in terms of fuel prices likely results in multiple bankruptcies. We continue to have no Buy recommendations and have Sells on AMR and JBLU.”

Just food for thought. This note was published this morning — BEFORE oil picked up more than $4 on the day, setting a new all-time high of $133.17 a barrel.

Jet fuel? Another new record, and this one is a big one.

Jet fuel closed today at over $4 a gallon. $4.09 a gallon to be exact.