Hello everyone. Happy Fourth of July! This week’s holiday issue of PlaneBusiness Banter is now posted.

Hello everyone. Happy Fourth of July! This week’s holiday issue of PlaneBusiness Banter is now posted.

This week we take a look at the latest news from American Airlines bankruptcy, including the extension for exclusivity that the airline and the Unsecured Creditors Committee have agreed to. Does this change anything? We think not, and we explain all the fine print of what it does mean.

Meanwhile, as expected, the board of directors of the Allied Pilots Association voted to send out the last best tentative agreement with the company to the rank and file for a vote. All of that will take us into August — one of the main reasons the exclusivity date was pushed back.

The “intensive” two week closed doors locked-down negotiations between the pilots at Continental, United, and the airline came to a close last week. But no contract was to be had. We are still optimistic, and we think the timing of the announcement concerning the results of the Delta Air Lines‘ pilot contract had a bit to do with what happened here as well.

Meanwhile, while all this was going on, Holly was in Chicago last week, attending and speaking at the Association of Travel Marketing Executives conference. More on all that in the our next issue. While I was in Chicago, I also got to take a tour of the United Airlines new network operations center. Wow. What a trip that place is. More on all that in this week’s issue as well.

In our AMR Bankruptcy Follies column this week, we tip our hat to our customary “Ode to a Hot Dog” column and give it a new twist, as we explore the top ten reasons American Airlines’ CEO Tom Horton doesn’t like hot dogs.

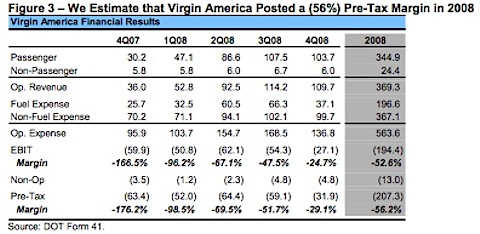

And oh, then there were the first quarter earnings that Virgin America issued on Tuesday afternoon. Yep, that’s right. The old “Vanguard” method. You know how that works. You issue bad earnings news on a day when no one is paying much attention. Like on the afternoon before July 4th.

That’s okay. We were paying attention, as were some of our subscribers.

The numbers were, in a nutshell, horrible. We ask — how long can this operation continue?

All this and more, including our second quarter airline stock performance review (in which US Airways handily took top honors) in this week’s issue of PlaneBusiness Banter.